Income Tax Notices in India: Types, Reasons & How to Respond

Introduction

Receiving an income tax notice can be unsettling. However, not all notices mean trouble. Many are routine and may simply request clarification or documentation. Learn how to deal with Income tax notices in India.

As a leading Chartered Accountant firm in Mumbai, Makwana Sweta & Associates helps clients respond accurately and confidently to such notices—minimizing stress and ensuring compliance.

What is an Income Tax Notice?

An income tax notice is an official communication from the Income Tax Department of India, sent under various sections of the Income Tax Act, 1961. It could ask for:

- Information

- Clarification

- Reassessment

- Tax payment

Importantly, responding within the deadline is crucial to avoid penalties, prosecution, or scrutiny.

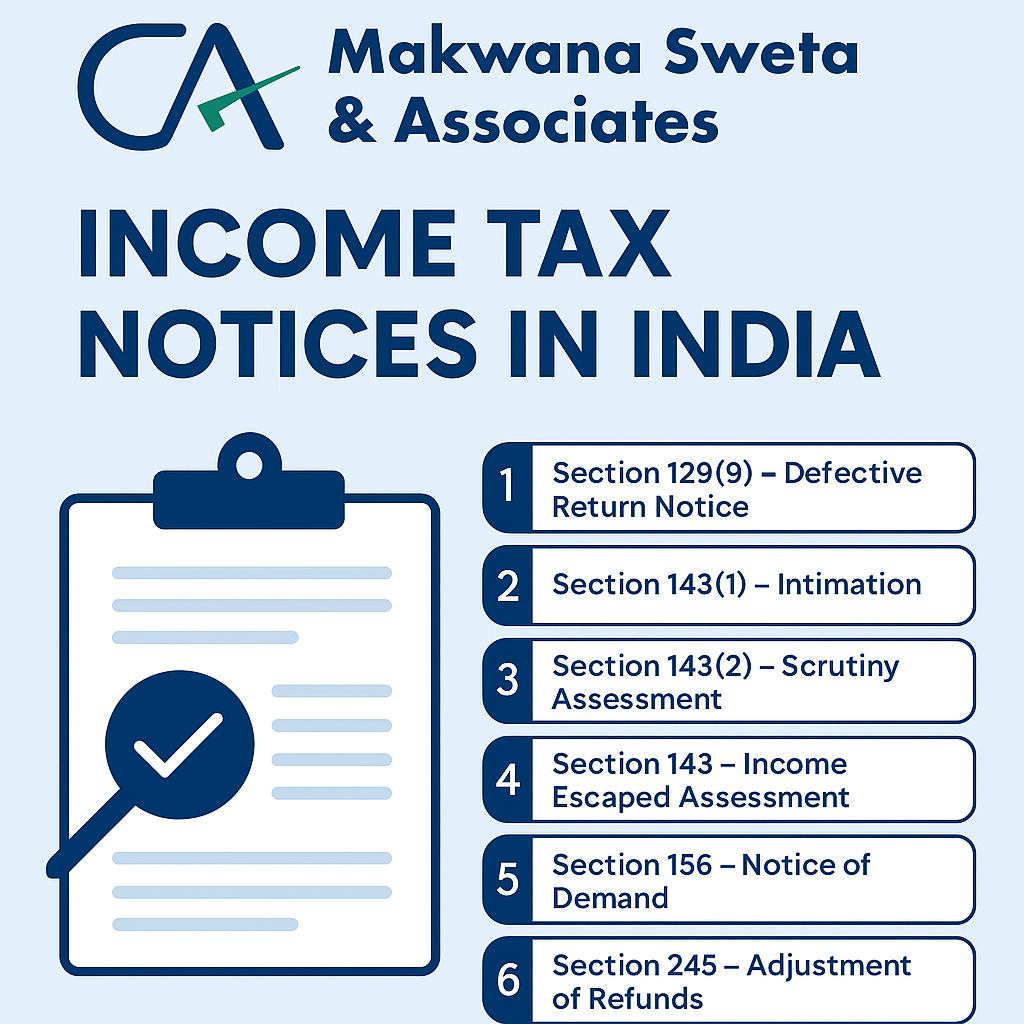

Types of Income Tax Notices in India

Let’s look at the most common notices individuals and businesses receive:

1. Section 139(9) – Defective Return Notice

The department sends this if your filed return is considered incomplete or inconsistent.

Example: You forgot to report income or submit required forms.

Action: Correct and re-file within 15 days.

2. Section 143(1) – Intimation

This isn’t a notice in the strict sense. It compares your filed return with the system’s computation.

It can result in:

- No refund or demand

- A refund

- A tax demand

Action: If there’s a mismatch, verify Form 26AS and correct errors via a revised return.

3. Section 143(2) – Scrutiny Assessment

This indicates that your return has been selected for detailed assessment.

Reasons may include:

- High-value transactions

- Mismatch in reported income

- Random selection

Action: Consult a Chartered Accountant in Mumbai for documentation and a proper response.

4. Section 148 – Income Escaped Assessment

If the department suspects you’ve underreported or omitted income, they’ll issue this notice.

Timeframe: Within 3–10 years depending on the amount and nature of the income.

Action: Respond with a revised return and supporting documentation.

5. Section 156 – Notice of Demand

This notice demands payment for:

- Tax due

- Penalty

- Interest

Action: Pay the amount within 30 days or file an appeal if incorrect.

6. Section 245 – Adjustment of Refunds

If you’re due a refund but have an outstanding tax liability, this notice informs you that the refund is being adjusted.

Action: Accept or disagree via the income tax portal.

Why You Might Receive an Income Tax Notice

Understanding the common triggers can help you stay compliant:

- Mismatch in income: Between Form 16, 26AS, and ITR

- Non-disclosure: Of assets, foreign income, or other sources

- High-value transactions: Large bank deposits, property deals, or stock trades

- Incorrect deductions: Under Section 80C, 80D, etc.

- Late or missed filing: Or errors in the return

How to Respond to Income Tax Notices

Follow these steps immediately after receiving a notice:

Step 1: Don’t Panic—Read Carefully

Every notice includes:

- Section under which it is issued

- Reason

- Response deadline

Step 2: Verify Against Records

Cross-check with:

- Form 26AS

- AIS (Annual Information Statement)

- ITR filed

Step 3: Consult Tax Consultants in Mumbai

A seasoned CA in Mumbai can help draft responses, prepare documents, and file a reply on time.

Step 4: Respond Online

Use the Income Tax Portal: https://www.incometax.gov.in

Navigate to “e-Proceedings” or “Worklist” and upload your response.

Step 5: Track Follow-ups

Ensure you get confirmation and track future communication.

Recent Changes in 2025 (Updated)

As per the Union Budget 2025, the following apply:

- AI-driven selection of scrutiny cases to reduce human bias.

- Time limit to reopen cases under Section 148 reduced to 3 years (except in cases over Rs. 50 lakh).

- Integration with DigiLocker for faster document validation.

Real-Life Example

A client of Makwana Sweta & Associates received a Section 143(2) scrutiny notice due to a mismatch in their stock trading income. With quick document review, revised capital gains calculation, and professional response, the issue was resolved without penalty.

Tips to Avoid Income Tax Notices

Here’s what you can do to stay off the radar:

- File accurate returns on time

- Report all income sources, including interest and dividends

- Match income with Form 26AS and AIS

- Avoid false claims under deductions

- Disclose foreign assets properly (if applicable)

Useful Links

- Inbound Link: Tax Deduction in India you didn’t know about

- Outbound Link: CBDT Income Tax Notices FAQ

Why Choose Makwana Sweta & Associates?

Our Chartered Accountant services in Mumbai go beyond tax filing. We provide:

- Prompt notice handling

- Legal compliance

- Audit defense

- Income disclosure management

Whether you’re a salaried individual, freelancer, or business owner—our CA firm offers PAN-India support to help you stay tax-smart and stress-free.

Conclusion

Income Tax Notices in India are manageable—as long as you respond correctly and on time.

Partner with Makwana Sweta & Associates, a trusted CA in Mumbai, to protect your finances and your peace of mind.

Need help with a notice? Book a consultation now.