Hindu Undivided Family (HUF): A Smart Tax Planning Tool for Indian Families

Introduction

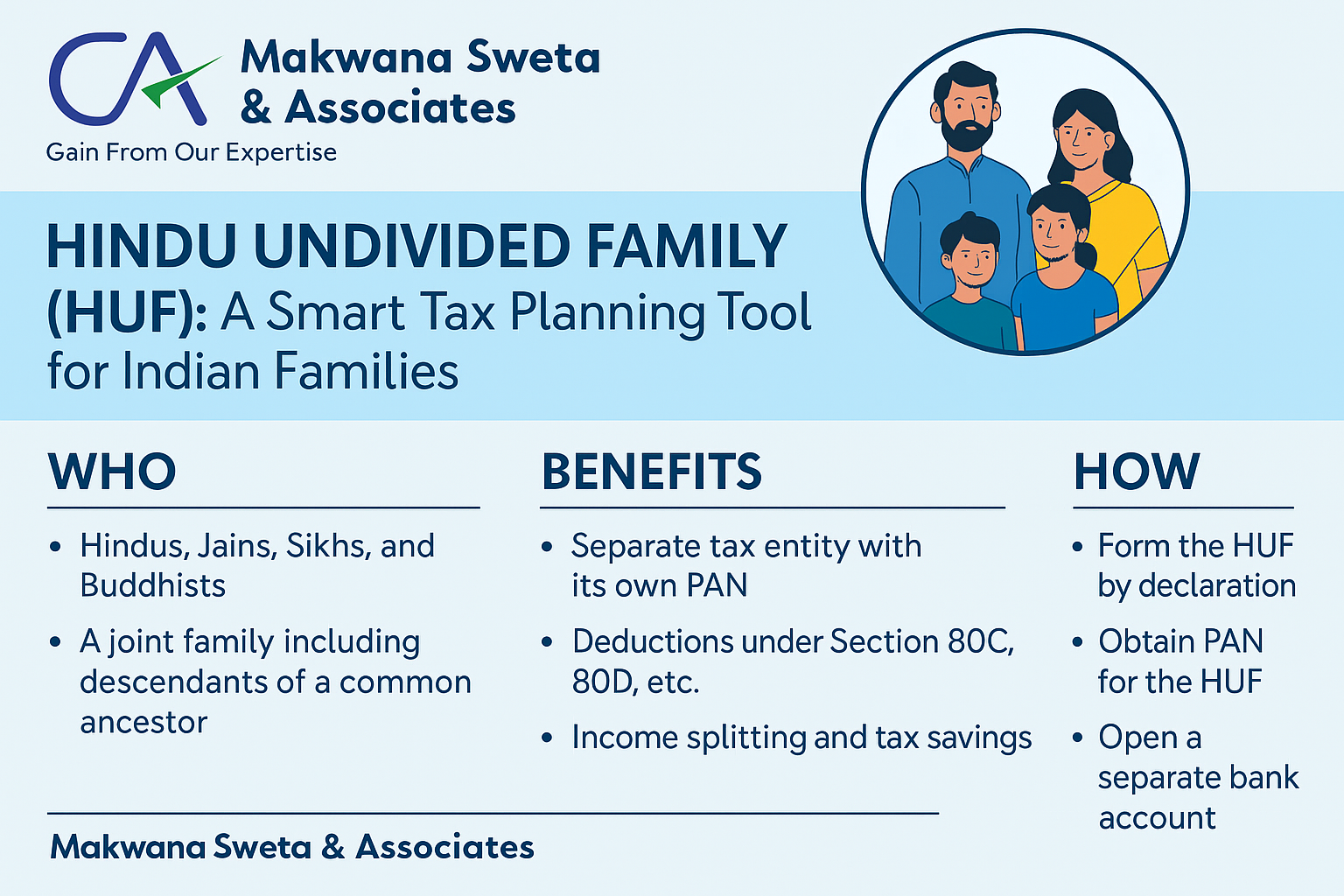

When it comes to legitimate and smart tax-saving strategies, the Hindu Undivided Family (HUF) structure stands out for Indian taxpayers. Recognized under the Income Tax Act, a Hindu Undivided Family enables eligible families to avail tax benefits by creating a separate entity for tax assessment purposes.

In this blog, Chartered Accountant Shweta Makwana from Makwana Sweta & Associates, a leading firm offering CA services in Mumbai and across India, explains everything you need to know about forming and managing an HUF.

What Is a Hindu Undivided Family (HUF)?

A HUF is a unique tax entity under Indian law. It comprises individuals who are lineal descendants of a common ancestor, including wives and unmarried daughters. The family operates as a single unit and can have its own PAN, bank account, and file a separate income tax return.

Who Can Form an HUF?

The HUF structure is only available to:

- Hindus, Sikhs, Jains, and Buddhists (as recognized under Hindu Law)

- Families with more than one member (even a married couple qualifies)

- Residents of India (NRI HUFs are allowed, but rules may vary)

The eldest member of the family becomes the Karta, i.e., the manager of the HUF.

Why Consider Creating a Hindu Undivided Family?

Here’s why thousands of Indian families legally form HUFs:

- Tax Benefits:

- The HUF is treated as a separate taxpayer.

- It gets a basic exemption limit of ₹2.5 lakhs just like an individual.

- HUFs can claim deductions under Section 80C, 80D, and others.

- Asset Holding and Inheritance:

- HUF can receive ancestral property, gifts, and income from such assets.

- It ensures joint family ownership while enjoying financial benefits.

- Effective Wealth Planning:

- By diverting income-producing assets into the HUF, families can reduce tax burdens across members.

- It helps with succession planning, especially in joint families.

How to Create a Hindu Undivided Family

Forming an HUF is simple but requires careful execution:

Step 1: Formally Declare the HUF

A declaration is made on stamp paper stating the intention to form an HUF. The Karta signs this along with other family members.

Step 2: Apply for PAN in HUF’s Name

You must apply for a separate PAN card for the HUF entity. This is essential for filing returns and opening accounts.

Step 3: Open an HUF Bank Account

Use the new PAN to open a dedicated bank account in the HUF’s name. All transactions related to the HUF are made through this account.

Step 4: Transfer Assets/Gifts to the HUF

Ancestral property, gifts, or voluntary contributions from family members can be transferred to the HUF. Ensure documentation and legal compliance.

Income Sources of a Hindu Undivided Family

A Hindu Undivided Family can earn income from the following:

- Rent from HUF-owned properties

- Interest from fixed deposits and savings

- Capital gains on sale of HUF assets

- Business income if business is run under the HUF banner

Note: Salary income of individual members cannot be diverted into HUF.

Taxation Rules for HUFs

- Separate ITR filing: The HUF must file its own return under ITR-2 or ITR-3 depending on income.

- Deductions Allowed:

- ₹1.5 lakh under Section 80C

- ₹25,000 under Section 80D (Health Insurance)

- Other deductions as applicable

Limitations and Risks

While HUFs offer numerous benefits, there are a few caveats:

- Difficult to dissolve: Once formed and assets are transferred, it’s hard to unwind without legal complications.

- Asset control: The Karta holds power, which may not sit well with all members.

- Tax scrutiny: Gifts to the HUF from non-family members may be taxed as income.

Common Misconceptions

| Myth | Reality |

|---|---|

| Anyone can form an HUF | Only Hindu families (including Sikhs, Jains, Buddhists) are allowed |

| Individual salary can be part of HUF income | Not allowed unless salary is from HUF business |

| Daughters don’t have rights | Since 2005, daughters have equal rights in HUF property |

Real-Life Example

Let’s say Krishna and Radha are married. Krishna earns ₹12 lakh annually. His family owns ancestral land that yields rental income of ₹5 lakh yearly. Instead of adding this ₹5 lakh to his income, Krishna sets up an HUF. Now, the HUF files a separate return, claims basic exemption and deductions, and Krishna pays less tax.

Should You Form an HUF?

Yes, if:

- You have ancestral property or joint family income sources

- You want to separate family-owned income and reduce taxes

- You aim for long-term wealth and succession planning

But consult a professional Chartered Accountant in Mumbai or pan-India expert from Makwana Sweta & Associates before proceeding. The setup and maintenance must comply with legal and financial norms.

Conclusion

The Hindu Undivided Family structure is a timeless strategy to legally minimize tax liabilities and streamline family wealth. Whether you are an established family business or a salaried individual with ancestral assets, setting up an HUF can be a game changer.

For tailored guidance, tax filing, and legal compliance support, connect with our Chartered Accountant Services in Mumbai or book a consultation with Makwana Sweta & Associates, your trusted tax consultants in Mumbai and across India.

For more information on HUF, visit the site of Income Tax Department, India.

Want to know about other smart ways to save taxes? Read this blog written by CA Sweta Makwana on Section 44ADA